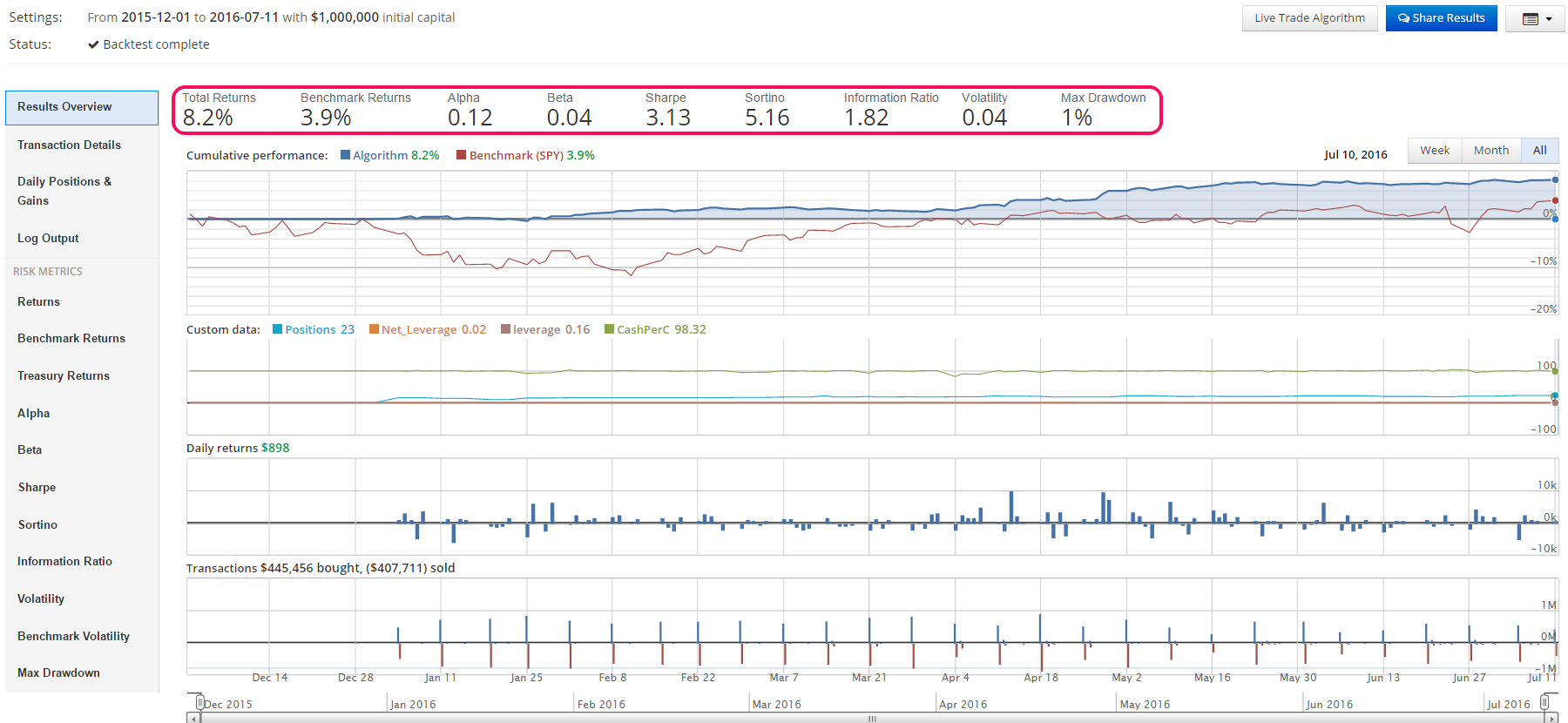

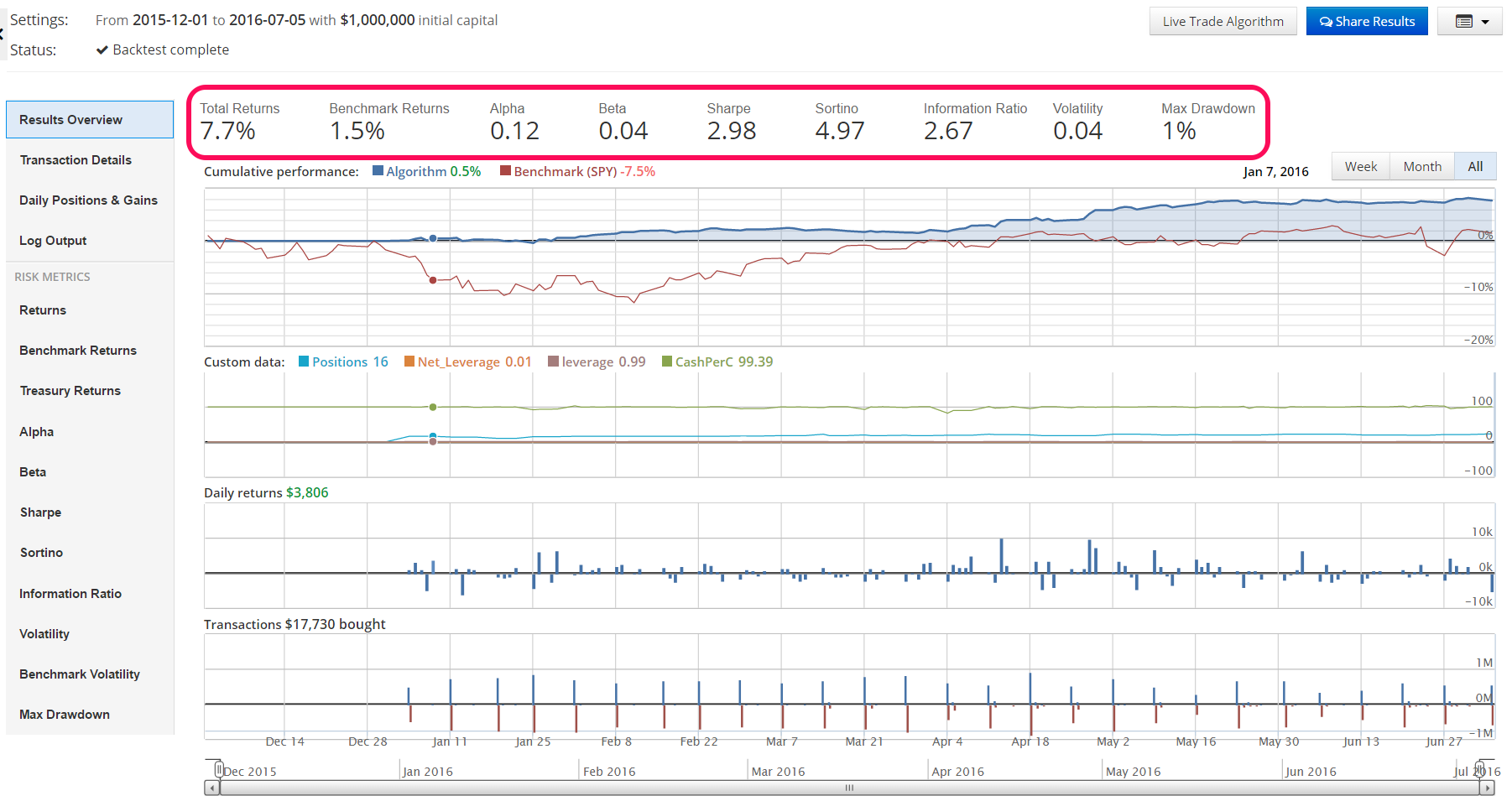

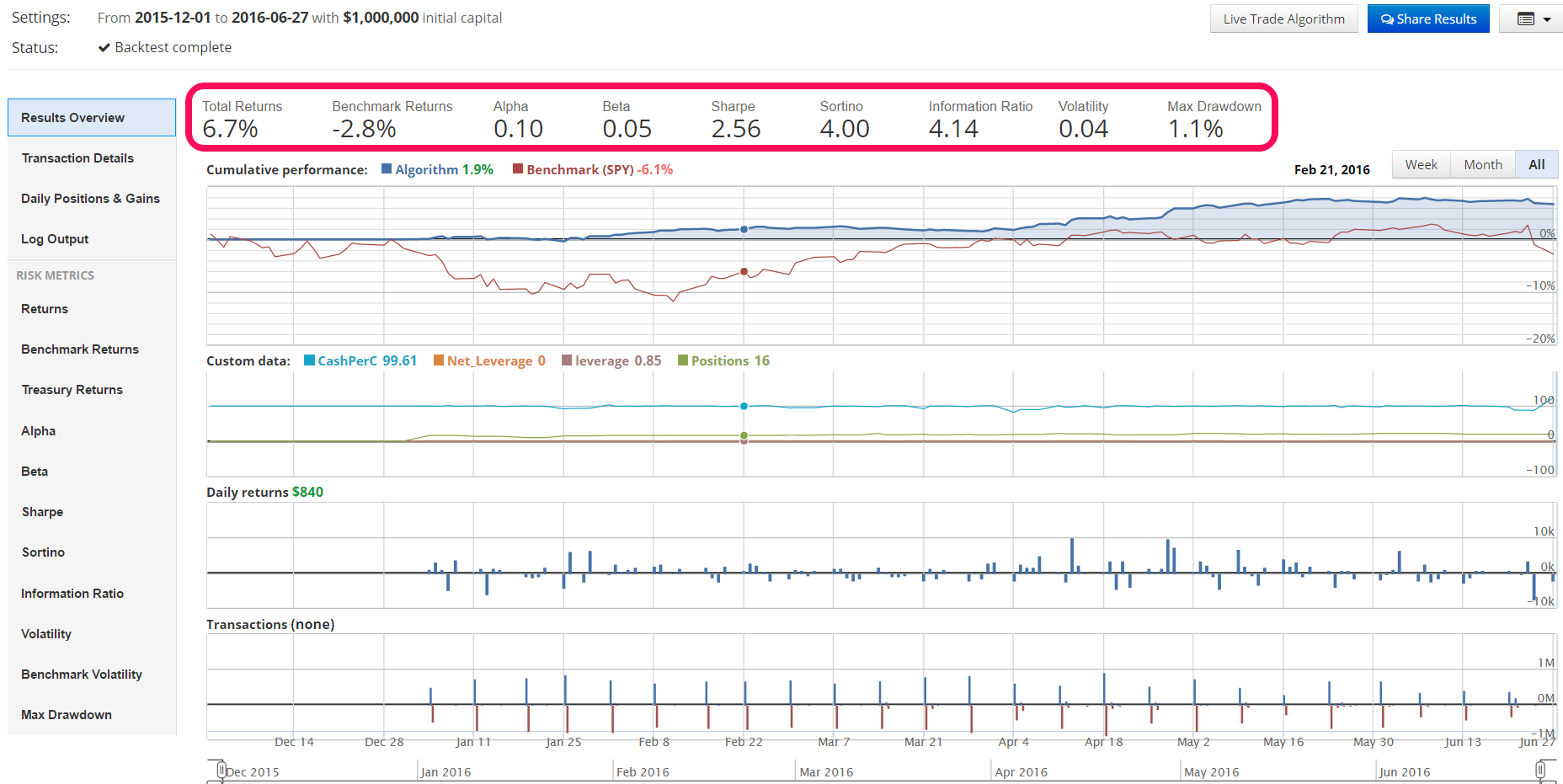

There are two versions of this strategy that I have previously tracked and reported. The original strategy consists of forming weekly portfolios each held for a period of four (4) weeks before being liquidated. The second strategy is a higher frequency version which forms weekly portfolios with a holding period of one (1) week. Thus far, both strategies have exceeded expectations. Their apparent theoretical success is so far beyond expectations it required much deeper investigation and better simulation. The returns being reported demand better validation.

Read More