WHO RUNS THE MARKET?

/A simple question, often overlooked to the investors' detriment.... In my ongoing pursuit to gain an edge in the market I’ve often thought it critical to analyze who the key players are. But even more broadly and perhaps of greater importance, I’ve often considered who or what forces have the power to “move the markets”. As a casual observer, or "unsophisticated" investor the most common market news you may encounter is pundits discussing stocks and the stock market, earnings reports, the FED and various economic indicators. The layman could hardly be blamed for thinking the stock market is the most influential economic market in the U.S. if not the world. Consider the enormous amount of attention that is given daily to the U.S. stock market. How critical it was and continues to be for the FED and government decision makers to consider “the market” in their decision making.

Here exists the ironic, easily obscured truth. When the FED and key shot callers reference “the market” most investors immediately think "the stock market". I used to be guilty of this myself, but it is not only a serious error but also a limiting thought process. Consider why? The equity market is in actuality the smallest of the actively traded markets. Let’s examine the data and the importance of this analysis will become clearer.

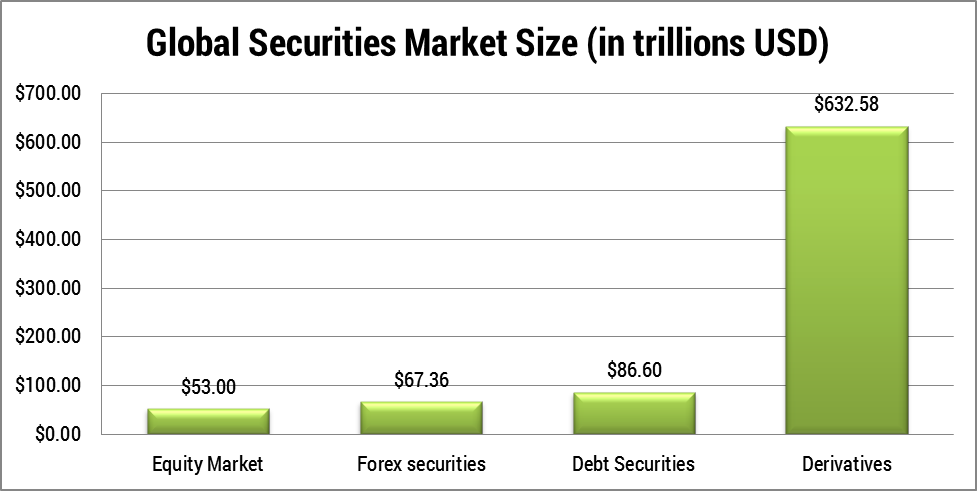

According to 2012 World Bank data, global equities had a market value of approximately $53 trillion current USD. The Bureau for International Settlements (BIS) quarterly data approximates Total global debt securities at $86.6 trillion. That’s over 1 and a half times the market value of all equities. The BIS Triennial 2010 survey, reported the foreign exchange (Forex) market had an OTC notional value of $63 trillion in total contracts. Total OTC derivatives accounted for $632 trillion in outstanding contract values. That’s 12x the size of the global equity market.

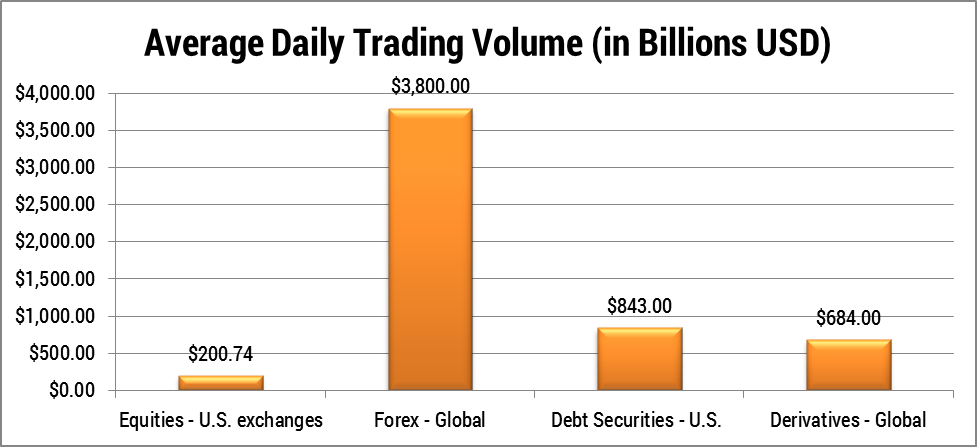

Average daily trading volume (ADTV) also helps tell the story.

Forex trading has the largest ADTV followed by U.S. debt securities, then global interest rate derivatives. Examining the ratios; Forex trading volume is almost 19x larger than U.S. equity market volume; U.S. debt securities 4.2x larger and interest rate derivatives are 3.4x larger.

Bottom-line, U.S. equities account for the smallest piece of the asset market pie, both in market value and average daily trading activity.

The implications cannot be overstated. The “market” is a huge web of interconnected asset classes arranged in a hierarchical order with U.S. equities located at the bottom. Equities serve as both an expression of market expectations on real economic output; and of the volatility occurring across all interest rate based securities.

Examining these larger securities’ markets can provide indicators to actionable trading ideas. The leverage and capital at risk is so large in these markets, significant, far reaching dislocations can occur as a result of something conceptually “simple”, like an interest rate hike or a currency peg. These events blow holes in the efficient market hypothesis and allow for astute traders to place favorable bets with asymmetrical risk-reward properties.

This subject will be an ongoing topic of discussion and analysis, as these events typically increase emotional intensity and therefore volatility. The extremes in emotions present the greatest opportunities for the prepared and courageous investor.