Synthetic ETF Data Generation (Part-2) - Gaussian Mixture Models

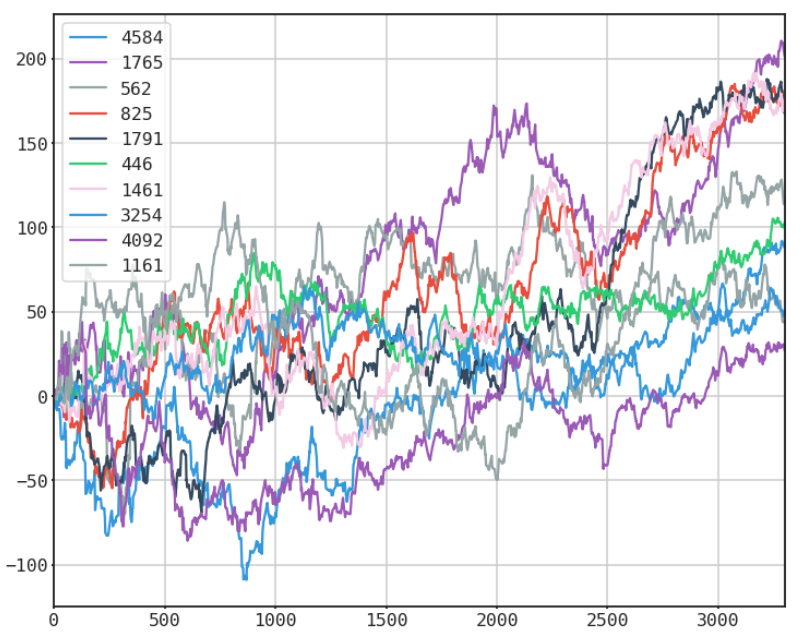

/This post is a summary of a more detailed Jupyter (IPython) notebook where I demonstrate a method of using Python, Scikit-Learn and Gaussian Mixture Models to generate realistic looking return series. In this post we will compare real ETF returns versus synthetic realizations.

Read More