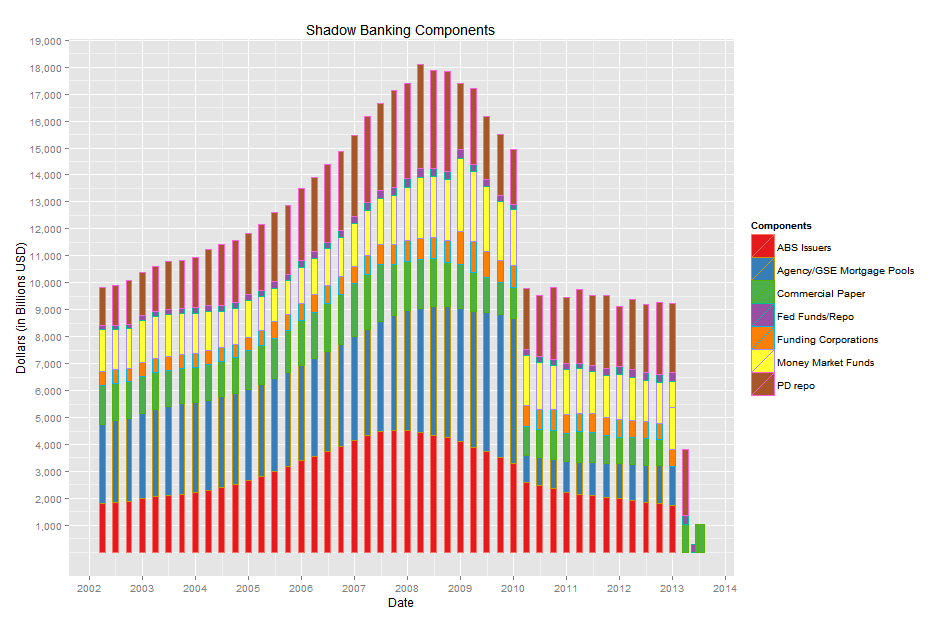

How large is this shadow banking market??

Estimates vary due to the inherent difficulty of quantifying ‘shadow’ assets. The most recent figures cited by the Federal Reserve and computed by the financial stability board has pegged the global shadow market at approximately $65 trillion USD; having peaked in 2007 at 128% of aggregate GDP* now settling in at approximately 111%.

Of the $65 trillion shadow market, the U.S. accounts for an estimated 35% or ~$23 trillion followed by the euro area at $22 trillion and UK at $9 trillion.

*aggregate GDP of 20 jurisdictions and the Euro area at end-2011

What is shadow banking?

Shadow banking is the unregulated creation of credit by regulated and unregulated entities. The ‘shadow’ moniker makes reference to the fact that this credit creation is often facilitated off-balance sheet and often difficult to quantify. The criteria for shadow banking activities is as follows:

-

Credit intermediation - facilitating transactions between lenders and borrowers

-

Maturity/liquidity transformation - fund long-term assets with short-term liabilities/illiquid assets funded by liquid liabilities

-

Lack of government guarnatee/access to central bank liquidity

-

Outside the regulated banking system

-

Credit risk transfer

Who participates in the shadow banking market?

The primary facilitators and lenders in this market include: hedge funds, bank holding companies, global asset managers, money market mutual funds; their subsidiaries via special purpose entities (SPE’s), structured investment vehicles (SIV’s), and other non-bank financial institutions including pension funds, endowments, insurance firms et al. On the other side are the borrowers who range from corporations to the aforementioned non-bank financial institutions.

How do shadow banks and traditional banks differ?

Traditional banks fund their loans via deposits whereas shadow banks use short term funding commonly provided by asset backed commercial paper and repo markets. There are other strategies to facilitate this funding but they are beyond the scope of this post. The lack of deposit taking is what allows these entities to evade traditional regulatory burden. This often translates to lower rates for the borrower when compared to traditional loan mechanisms. Lower fees = popularity = increasing market share/size.

I’m confused, what are asset backed commercial paper and repo agreements?

Asset backed commercial paper functions like a pass through debt security with maturities typically between 1 and 270 days. Companies looking to increase liquidity sell a portfolio of receivables to “banks” who then securitize the cash flows and sell them to investors. As the cash flows for the receivables are paid to the company they pass them along the chain, via the “bank” who in turn redistributes the funds to the investors.

EXAMPLE:

Bell computers sells receivables to ⇒⇒ Oldman Scratch bank who packages and sells to ⇒⇒ Investors

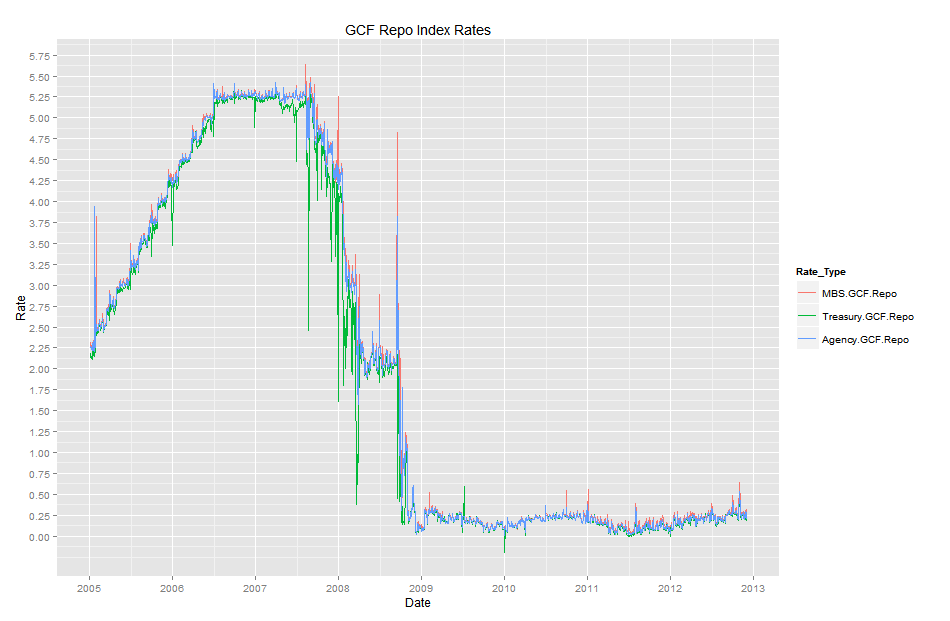

Repurchase agreements also function as short term funding vehicles. It works when a firm sells collateral (usually some other debt or equity security) to a buyer. Accompanying this sale and purchase is a contractual agreement where the seller agrees to buy the collateral back at a later date and a higher price. The difference in price is effectively the interest rate on the cash flows. This is commonly called the repo rate.

EXAMPLE:

Phase 1_

Company A needs cash and sells collateral to ⇒⇒firm B who buys or effectively loans company A the money while taking legal ownership of the collateral

Phase 2_

@ maturity company A buys back the collateral at the agreed upon price effectively returning the principal plus interest ⇒⇒ firm B collects the cash and returns the collateral and legal ownership.

Why is this important??

This is important because there are ~$65 trillion in assets that operate outside of traditional regulation. The shadow banking market was shown to play a pivotal role in the financial meltdown as the generationally low interest rates at the time did NOT compensate investors and/or lenders for increasing risk. As a result many of these sub sectors within the shadow market grinded to a halt as lenders refused to roll over debt. Rates blew out, and firms had to liquidate assets at ‘fire sale’ prices in order to pay their liabilities. Adding to the problem was the interconnectedness of these firms. The shadow market contained assets and liabilities that were seemingly impossible to quantify and assign. This created a negative feedback loop in the market as people did not know who owed who, whose assets were money good or completely illiquid, or worse-completely worthless.

The shadow banking market is not growing at the pace it once was but it is incredibly influential. A sophisticated investor must be aware that it exists and is large and find ways to keep track. Dislocations in the shadow market often provide profitable opportunities. In future posts I will breakdown some useful proxies to help track this market.